If you have dropped your credit score, you can appeal this decision by writing a letter to the credit bureau. In this article, we’ll discuss how to format your appeal letter as a business letter. We’ll also cover how to Defend your credit report from errors and inaccurate information. In addition, we’ll outline a few tips for writing a convincing letter. Follow these tips to write an effective appeal letter for your credit report.

Formatting your appeal letter as a business letter

Before drafting your appeal letter, you must know whom to address it to. Be sure to address it to the person who is in charge of the case. The key to writing an effective appeal letter is to be objective and concise. Avoid blatant appeals to emotions, as this may not work. Avoid exaggerations, judgments, or any other hint of anger. Always format your letter as a formal business letter.

You may wish to review sample sentences to help you create clear sentences. It is not appropriate to begin your letter with a typical business letter opening. Instead, you may want to address the committee members by their names. You should also express your gratitude to each member of the appeal committee. If the appeal committee has taken the time to review your appeal, you should express your gratitude for the time they have given you.

Extenuating circumstances that led to a drop in your credit score

If you’ve been plagued by negative credit reports for a long time, it may be time to write a petition letter explaining your situation. The letter may explain why you had to file for bankruptcy due to medical expenses, or that a personal loan was mistakenly sent to collections. Perhaps you recently moved and put all your moving expenses on a credit card. Whatever the reason, writing a petition letter can help you regain control of your credit score and your financial future.

Your letter should start with a formal statement that explains your situation, along with a concise outline of your facts. Make sure to include a copy of the report you are disputing. If you’ve lied about your income, for example, your landlord’s name was incorrect, you may not be able to show the landlord that you paid your rent on time. Also, if you’ve repeatedly mismanaged credit, your letter should contain evidence to support your allegations.

Dispute errors on your credit report

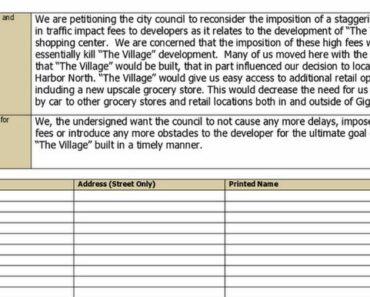

If you find an error on your credit report, you have several options. First, you can send a dispute letter to the furnisher of the information. Include any supporting documents or information you believe is inaccurate. Make sure to keep a copy of everything you send, including the dispute letter. Use the dispute address on your credit report, or find a sample dispute letter. You can also use certified mail and return receipt to send your dispute.

The dispute letter should contain your name, address, and the inaccurate information. If applicable, you should include copies of your current bank statements, tax returns, or any other relevant documents. Many businesses require specific addresses to receive a dispute. Contact the business to get the address. You will also need to attach a copy of your credit report, and any documents supporting the dispute. Make sure you document your efforts clearly so that you can prove your point.

Defending inaccurate information on your credit report

If you believe that there is inaccurate information on your credit report, the first step is to write to the bureau responsible for the inaccurate information and dispute it. If the information was inaccurate, send a copy of your identity, your full middle name, and any supporting documentation. If you can’t find any documentation, file a dispute letter to the bureau in question. This can take several weeks or months. Once the bureau has acknowledged your dispute, you can follow up with them by phone or in person.

Many consumers do not realize that they can dispute inaccurate information on their credit reports. This is a legal right and the bureau must remove the information if it is inaccurate. Common errors include payments that are labeled as late, accounts that are closed, and even information from someone else. Fortunately, most mistakes on credit reports are minor and are not considered detrimental to your creditworthiness. However, if you are the victim of identity theft, inaccurate information can have serious consequences.